QuickBooks Payroll is our runner-up for best overall because of how well-rounded their offering is combined with their ability to connect so seamlessly with QuickBooks, which is the most widely used accounting software for small businesses. Intuit QuickBooks Payroll offers many of the same features that Gusto does, even down to health benefits for employees.

Users can even get a dedicated team that intimately knows their account if they opt for the most expensive plan. Both are available Monday through Friday. Chat is available from 6 am to 4 pm PT, while phone hours are between 7 am and 3 pm or 4 pm PT based on what level of service you select. They offer phone, chat, and email support. Accounting Integrations: QuickBooks, Xero, and most other accounting softwareĪdditionally, Gusto’s customer service is highly rated.Year-End Fees: Issues year-end W2s and 1099s, included in the price.Tax Services: Offers a penalty-free tax guarantee, automatically calculates taxes and withholdings, and automatically formulates end-of-year tax forms.Pricing: $39 to $149 + $6 to $12 per employee per month.Here’s a more detailed breakdown of Gusto’s payroll service: From automating your entire payroll to servicing businesses in many states, Gusto is a great option for any business but really tops the other options for small businesses that need the most help. Their pricing is competitive and Gusto’s features are loaded with everything that businesses without an internal payroll team will love. Gusto is our best overall payroll service because it is easy to use and provides an all-in-one solution that works for most businesses. We researched and reviewed more than two dozen payroll services and chose the best seven based on pricing, features, ease of use, customer service, and more. Here are our top picks. Each takes away the worry about whether you’re doing payroll correctly or not and helps you handle payroll with little effort and without a large team to complete the work. "Payroll services" is an all-encompassing term that includes both payroll software that will help you process your payroll yourself and also outsourced services that will handle all of the payroll on your behalf.

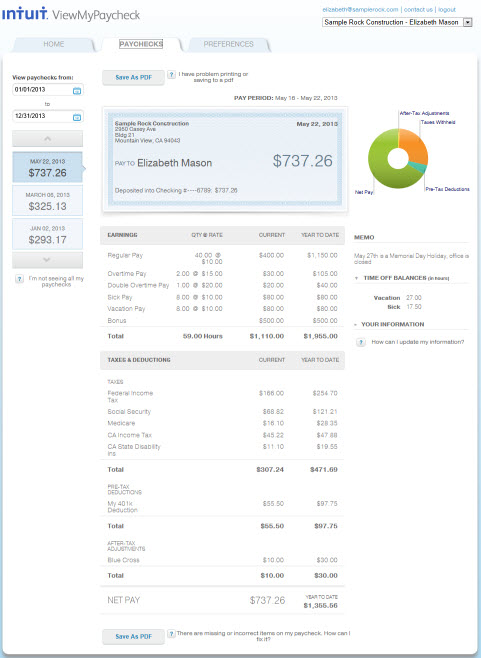

QUICKBOOKS PAYROLL SERVICE W2 FREE

The best payroll services will offer an automated solution that collects employee time, calculates and processes payroll, and includes free end-of-year tax filings. Payroll services do all of the hard work for you and keep you up to date on any legal requirements for your state so that you can focus on running your business. According to data from the IRS, 40% of small businesses pay an average of $845 per year in penalties. Payroll can be complex and difficult to complete on your own, especially if you have more than a few employees. Payroll services provide a solution that makes it easier to calculate employee pay, deliver payment, and send required tax forms. Read our advertiser disclosure for more info.

We may receive compensation if you visit partners we recommend. We recommend the best products through an independent review process, and advertisers do not influence our picks.

0 kommentar(er)

0 kommentar(er)